Iraq’s Block 9 oil field will receive a $346 million boost from new financing. The funds aim to support ongoing drilling campaigns and enhance the field’s infrastructure rapidly. Kuwait Energy Basra Limited, operator of Block 9 oil, secured the reserve-based financing facility.

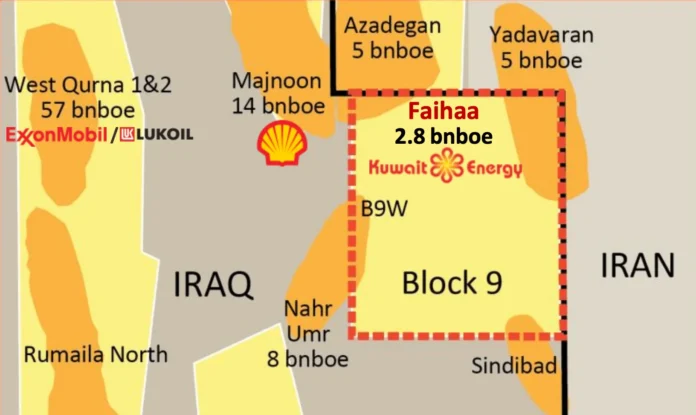

The financing package was organized by the Arab Energy Fund, acting as lead arranger and structuring bank. Kuwait Finance House and Trafigura Pte. Ltd. also participated as mandated lead arrangers for the loan. Block 9 oil comprises the Faihaa field located in Iraq’s southern Basra province.

KEBL, a wholly owned subsidiary of Hong Kong-listed United Energy Group, will manage development projects. The new funds will directly support drilling activities and infrastructure upgrades to sustain production efficiently. Iraqi authorities view such financing as essential to maintain output and reduce decline in aging reservoirs.

As OPEC’s second-largest producer, Iraq relies on oil exports for the majority of national earnings. Southern fields contribute most of Iraq’s production, but investment is critical to maintain long-term energy stability. Therefore, the Block oil development is a key part of Iraq’s greater upstream portfolio supporting export commitments.

Reserve-based lending has become increasingly popular among Iraqi companies to fund expansions while controlling capital expenditure. Experts emphasize that external financing provides flexibility and mitigates risk in volatile global oil markets. The facility will enable KEBL to accelerate progress at Faihaa and optimize field output strategically.

Officials highlighted that Block 9 oil remains central to Iraq’s broader strategy for stabilizing production levels nationally. The development aims to ensure energy security and improve export capacity despite global market uncertainties. Baghdad continues to encourage investments in southern fields to counter natural declines and maximize long-term reserves.

The new funding also reflects growing confidence from international financial institutions in Iraq’s oil sector. Authorities expect the facility to improve operational efficiency and maintain Block 9 oil as a reliable contributor. Analysts believe successful execution will strengthen Iraq’s position in global energy supply chains significantly.

With Block 9 oil development progressing, Iraq can sustain production while securing financial backing for future expansions. Long-term investment strategies will focus on maintaining output and ensuring energy stability across the southern fields.