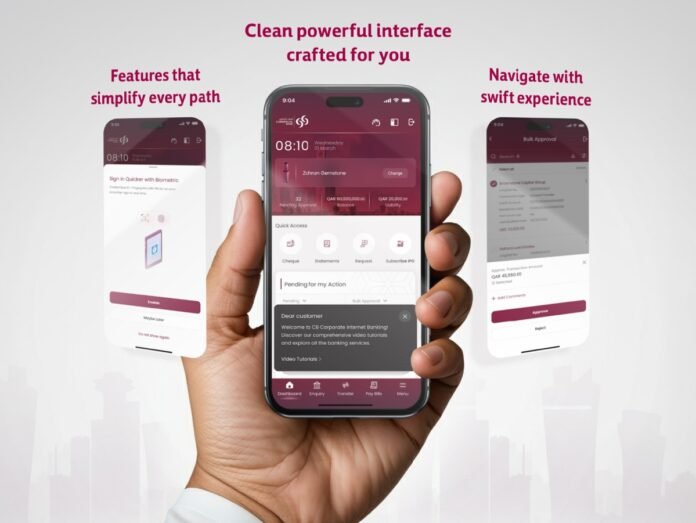

Commercial Bank has officially launched its all-new Corporate Mobile Banking App, marking a major leap forward in digital banking services for businesses in Qatar. Known for its leadership in innovation, the bank continues to set new standards by offering secure, fast, and convenient financial solutions directly through smartphones.

With this launch, Commercial Bank reinforces its commitment to providing digital tools that meet the evolving needs of Qatar’s dynamic corporate sector. The app allows businesses to manage critical financial operations remotely. For example, users can initiate and approve single or bulk transfers, manage corporate cards, and generate official bank letters—all from a mobile device.

Moreover, the app integrates cutting-edge security features such as biometric login and CB Safe ID verification, ensuring maximum protection for every transaction. These features guarantee not just convenience but also peace of mind for corporate users.

Fahad Badar, EGM and Chief Wholesale and International Banking Officer, highlighted the significance of the new tool. “Qatar’s dynamic business environment demands banking solutions that keep pace with commercial needs while maintaining rigorous security standards,” he stated. “This app effectively transforms mobile devices into powerful financial tools, blending technology with simplicity to drive efficiency.”

In addition to standard features, the app empowers businesses with the ability to:

- Approve high-volume transactions on the go.

- Process Wage Protection System (WPS) payments.

- Settle utility bills and taxes with the General Tax Authority.

- Generate essential documents instantly.

- Execute real-time transfers via the Fawran service.

Thanks to these functions, businesses now have full control over their financial activities, anytime and anywhere. This transformation supports Qatar’s broader digitalization goals and streamlines how companies operate in a competitive economy.

The Corporate Mobile Banking App is now available for download on both iOS and Android platforms, offering businesses an agile and secure banking experience.